The Sunday Edition of The Second Income Stream 4-6-25

New Income Fund Ideas & GP's Playbook for The Week Ahead

Hey, MFG!!🤘

YES! YES! YES!👏👏

The Second Income Stream is focused on two key things: growing your share count and maximizing dividend income.

Are you tracking how much you earn in dividends each year, month, week, day, and even hourly? These numbers matter—and calculating them should become second nature and automatic.

I count my net worth and dividend income daily.

The priority here is income.

This isn’t about trading or chasing quick gains. Selling funds to take profits only reduces your share count, lowers your income, and often leads to unnecessary taxes.

Instead, the goal is to acquire more income-producing assets, reinvest your dividends, and let compound growth do the heavy lifting.

Now more than ever, this strategy is critical.

With global markets tumbling in response to President Trump’s aggressive tariffs—and China retaliating—the headlines are full of fear, and the volatility is shaking loose the weak hands.

But here’s the truth: market crashes are rare and powerful wealth-building opportunities.

They are not setbacks for the prepared—they are setups. These moments separate the mentally strong from the weak.

If you stay focused, keep buying, and reinvest through the storm, you position yourself to build massive wealth when the cycle turns!!

This isn’t just a strategy—it’s your blueprint to financial freedom.

It takes discipline and vision, but the reward is real: a scalable stream of passive income that lets you live on your terms, doing what you want, when you want—for life.

The markets are presenting us with an amazing opportunity to get RICH!!

Right now, we watch and wait for the Money Flow stage 1 setups. Patience is key.

The Sunday Edition of The Second Income Stream 4-6-25

Tier 1: Anchor Funds

Aberdeen Standard Global Infrastructure Income Fund (ASGI)

Aberdeen Global Infrastructure Income Fund ASGI 0.00%↑ is in a stage 4 decline below its 200-day SMA and trading at an extreme-low RSI reading.

Price closed today with an imperfect doji on an extreme RSI reading, which could indicate a possible reversal and bottom here.

ASGI is a closed-end management investment company that aims to provide a high level of total return with an emphasis on current income.

The fund invests primarily in a diversified portfolio of income-producing public and private infrastructure equity investments worldwide, including sectors such as industrials, utilities, energy, communication services, real estate, materials, and information technology.

I’m looking to pick up more shares here once price sets up.

🐼Other Tier 1 anchor funds I’m watching or looking to add to this week: GOF, CLM, CRF, GUT, ECC, EIC, TLT, YYY, PSEC, HIPS, BCAT, ECAT, BIZD, REM, USA, and ASG.

Tier 2: Leveraged-Index Option Income ETF

Defiance Nasdaq Enhanced Options & 0DTE Income ETF (QQQY)

Defiance Nasdaq Enhanced Options & 0DTE Income ETF QQQY 0.00%↑ is in a stage 4 decline below its 200-day SMA and trading at an extreme-low RSI reading.

QQQY is one of my favorite income funds. This is an awesome opportunity to start a new position or pick up a nice chunk of shares!!

QQQY is 30% MM.

QQQY is an actively managed options income ETF that seeks to generate high weekly income by implementing a synthetic covered call strategy on the Nasdaq-100 Index QQQ 0.00%↑ .

Unlike traditional covered call ETFs, QQQY uses long synthetic positions instead of owning the underlying stocks, allowing for capital efficiency and potentially higher option premium income.

This ETF appeals to income-focused investors who want exposure to tech-heavy Nasdaq stocks while collecting enhanced options premiums; however, traders and investors should be aware that the strategy caps upside potential and may experience volatility due to its derivative-based approach.

🐼Other Tier 2 funds I’m watching or looking to add to this week: AIPI, BITO, CEPI, YMAX, YMAG, GIAX, SPYI, XPAY, RDTE, XDTE, QDTE, RDTY, QDTY, SDTY, WDTE, IWMY, QQQY, SVOL, and ZVOL.

Tier 3: Single Real Estate Investment Trust (REIT)

AGNC Investment Corp. (AGNC)

AGNC Investment Corp. AGNC 0.00%↑ is in a stage 4 decline below its 200-day SMA.

I’ve been in this mortgage REIT for years in my buy & hold account. This is one of my favorite REITs. AGNC pays a monthly dividend and is 45% MM.

Once price sets up, I’ll be looking to accumulate more shares and also open a B&B trade in my Second Income Stream account.

AGNC is part of the Real Estate sector XLRE 0.00%↑ and the Mortgage REITs sub-sector of the SPY.

Remember, this is a singular REIT. Maintain a proper position size of 1-3%.

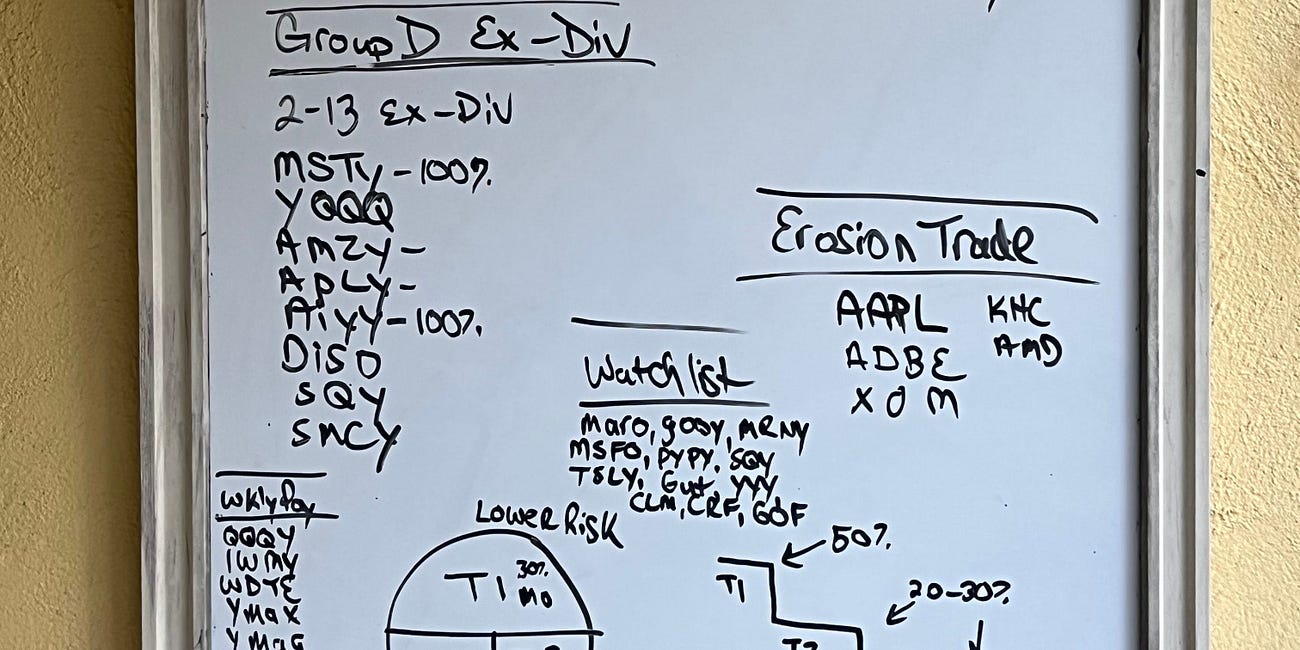

🐼Other Tier 3 funds I’m watching or looking to add to this week: MSTY, AMZY, XYZY, GOOY, TSMY, SNOY, PLTY, APLY, OARK, ULTY, and GPTY. Mortgage REIT ARR as well.

Below is GP’s private video on position sizing.

Tier 4: Erosion Buster Trades

Walmart, Inc. (WMT)

Walmart Inc. WMT 0.00%↑ is in a stage 1 accumulation zone right above its 200-day SMA.

Price dropped an anchor point, went sideways for 4 days, and closed above its 5-day EMA. The RSI went extreme, the MACD histogram started ticking upwards to the bullish side and the TSI had curled and crossed.

There was full confluence of the Money Flow indicators and price entered a stage 2 breakout.

After breaking out for a few days, price came back into its stage 1 box which is pretty bearish. Price then broke through its anchor point and 200-day SMA, but it redeemed itself and closed back above both today!

Price is back in the box! This trade is back in play. Let’s see if price continues to hold here before starting a trade.

Targets are an extreme-high RSI reading or $104.

WMT is included in the Consumer Staples sector XLP 0.00%↑ and the Personal Products sub-sector.

🐼It’s really slim pickings right now when it comes to trades that are setup, but these are the erosion buster trades I’m watching or looking to add to once the markets set up: AAPL, XOM, F, PEP, CART, UBER, RACE, FCX, and NUE.

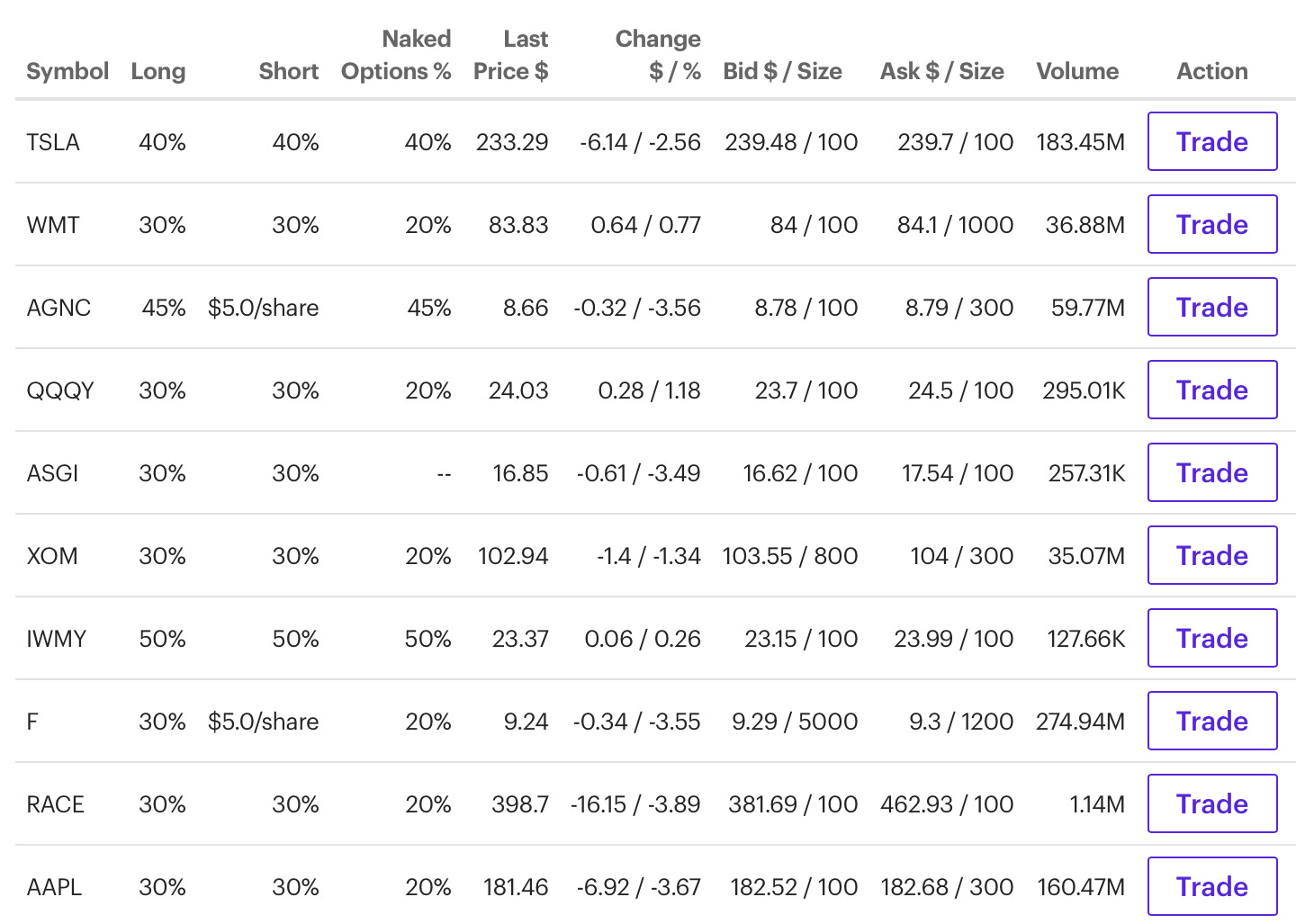

E*Trade Margin Maintenance (MM) Requirements

Current E*Trade margin maintenance (MM) for the mentioned securities in this article.

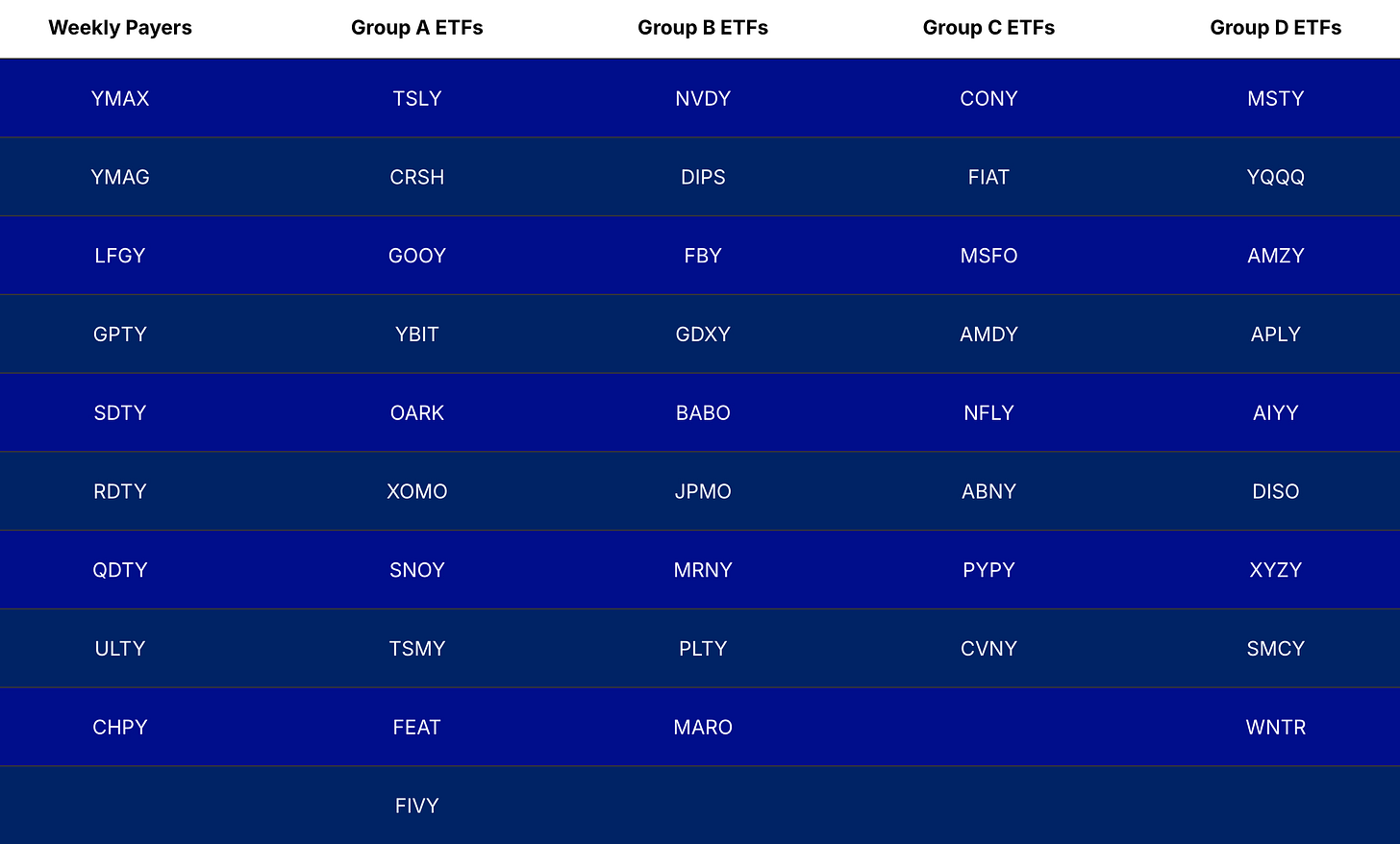

YieldMax Funds divided by Weekly Payers & Groups‼️

G’s Wrap-Up🐼

I think it’s safe to say I’m looking to add money to drip across my whole portfolio with all of these deals!!

Watch and wait for the setups!! This is an amazing time to build your anchor positions and leveraged index weekly paying funds!!

Patience is key. Gather cash and let the setups come to you!

LETS GO, MFG!!!

This is the time we shine!

👉Let me know in the comments if you have any questions.👈‼️

I truly appreciate you and your continued support, commitment, and motivation. If I can do anything to help you, let me know.🤘

Always remember, whatever you think about comes about, whatever you focus on grows. - GP 🐼

The Second Income Stream - Your Guide To Achieving Financial Freedom

THE SIS HOMEWORK ARTICLE - GP’s NEW TEMPLATE

GP’s Latest Second Income Stream YouTube Video

Keep in Flow🌊

Financial Disclaimer

The information provided in this publication is for educational and informational purposes only and does not constitute financial advice, investment advice, or a recommendation to purchase or sell any securities. Past performance is not indicative of future results, and all trading and investment decisions carry inherent risks.

Participants should conduct their own research and consult with a licensed financial advisor or professional before making any financial decisions. Gerald Peters and The Second Income Stream are not liable for any financial losses incurred as a result of trading or investing based on the strategies discussed in this publication .

By subscribing to this publication, you acknowledge and agree to assume full responsibility for your trading and financial decisions.

I need more money. 🤑

Dividends came in this last weekend. Thanks for your erosion trade potentials. Everything is on sale, just need it to set up!