The Abundance Mindset in a Market Selloff: How To Turn Fear into Profit💪

How to use this market correction to build lifelong wealth.

Hey, MFG!!🤘

YES! YES! YES!👏

Markets are selling off. The headlines are filled with panic, and many investors and traders are watching their portfolios drop in value and they’re either scared or excited.

Some are rushing to sell, moving their money to cash, and hoping to minimize further losses.

History shows that selloffs are not a time to retreat—they are the greatest wealth-building moments for those who know how to take advantage of them.

The stock market moves in cycles and stages, and downturns are an inevitable part of investing.

Those who operate with a scarcity mindset see these corrections as threats. They focus on short-term losses, react emotionally, and miss opportunities.

In contrast, those with an abundance mindset understand that market pullbacks create the best entry points for long-term wealth accumulation.

They see discounted stock prices, higher dividend yields, and a chance to build more income-generating assets!!

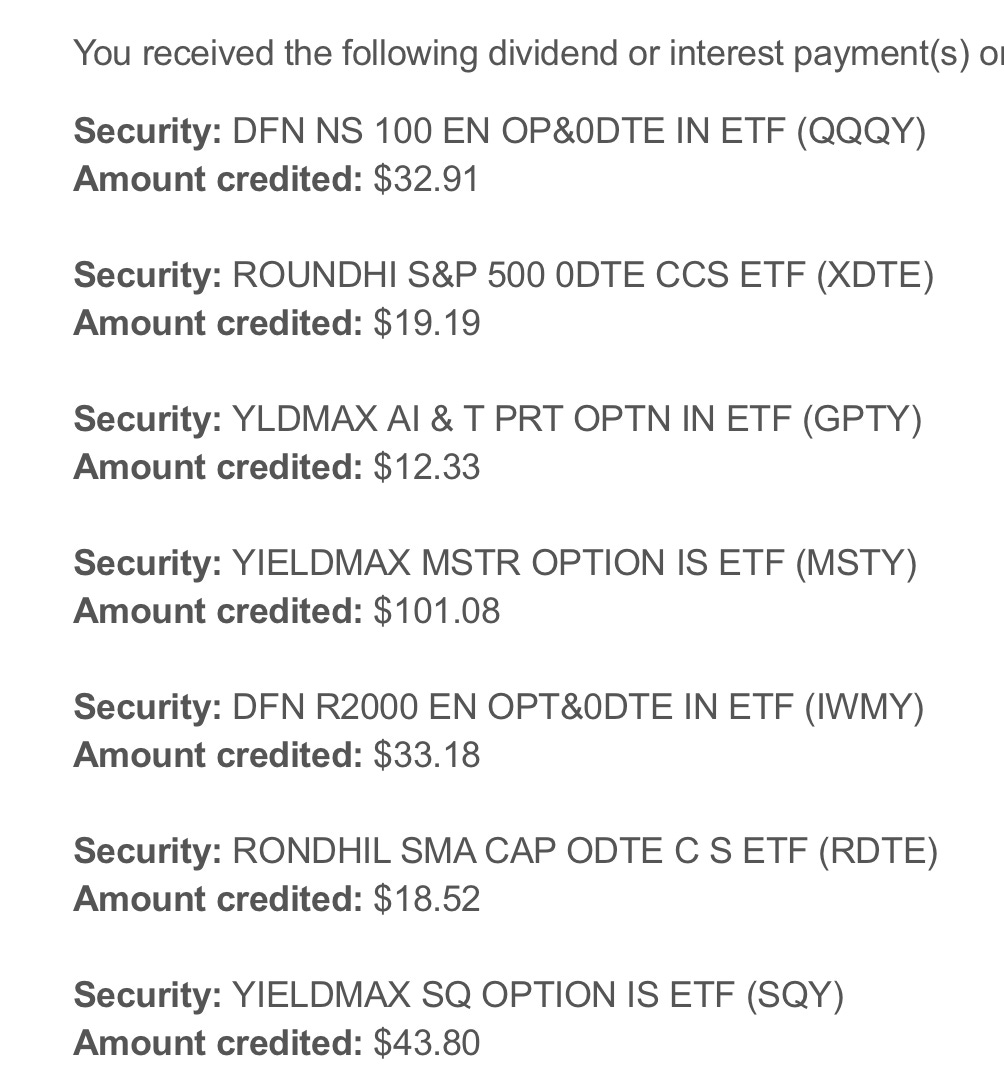

The Second Income Stream thrives in moments like this. When prices fall, the opportunity to accumulate more income-producing shares at lower prices increases.

The key is shifting focus from short-term volatility to long-term financial freedom— from the scarcity mindset to the abundance mindset.

Market Selloffs Are Buying Opportunities, Not Setbacks

Most investors and traders look at a declining portfolio balance and feel fear. They see red numbers, assume the worst, and make emotionally driven decisions

However, the best investors approach selloffs with a completely different perspective.

They know that stock prices may be down, but the value of future income is rising.

When prices drop, dividend yields go up!

A stock that paid a 4 percent yield before the selloff might now be yielding 6 or 7 percent simply because its price has fallen. This means that every dollar invested now will generate more passive income in the future.

Market selloffs create one of the only chances investors and traders have to buy high-quality assets at a discount.

Instead of focusing on temporary fluctuations in account value, it is more useful to ask:

How many more shares can I accumulate while prices are lower?

How much additional dividend income can I generate by buying now?

What high-yield investments are becoming available due to market fear?

By thinking in terms of cash flow rather than price movement, investors position themselves to come out of this downturn wealthier than they were before it.

The Second Income Stream Thrives in Volatility

Many people mistakenly believe that all income stops during market downturns. This is not the case.

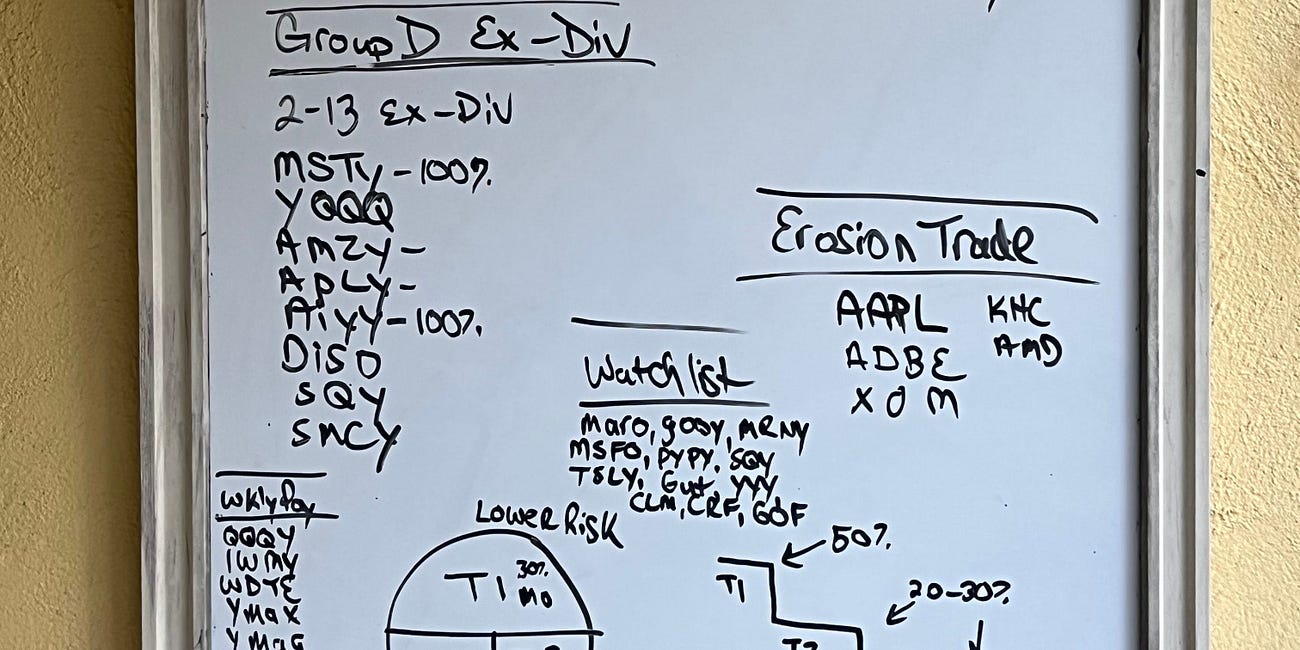

Dividend stocks, covered call ETFs, and income-focused funds continue to pay distributions even as prices fluctuate. High-yield assets, such as REITs, business development companies, and option income funds, often see higher payouts when volatility increases.

During times of market stress, smart investors double down on their income strategy.

They reinvest dividends, buy more shares at lower prices, and position themselves for a larger passive income stream in the future.

The goal is not to avoid market cycles—it is to use them strategically to create an ever-growing second income.

Cash Flow Is on Sale—Now Is the Time to Buy

One of the biggest mistakes investors and traders make is hoarding cash during downturns.

Fear keeps them sidelined, waiting for the “perfect” moment to buy, but markets do not send invitations when they bottom. And it doesn’t present golden opportunities to those who don’t show up everyday.

By the time it feels comfortable to invest again, the best opportunities are gone.

Instead of sitting on the sidelines, investors should think about where capital can be deployed most effectively right now.

Market corrections provide:

Stocks and funds at discounted prices

Higher dividend and yield opportunities

The ability to compound investments faster through reinvestment

If passive income is the goal, then this selloff is a chance to accelerate financial independence.

Leverage The Fear—Don’t Be Controlled by It

Investors and traders with an abundance mindset know that market corrections are temporary, but the wealth built during them is permanent.

Instead of fearing volatility, they use it as a tool to strengthen their portfolio.

There are several ways to take advantage of a downturn:

Buying shares on stage 1s at much lower prices.

Reinvesting dividends to accumulate more shares at a discount.

Using margin selectively to scale holdings while prices are lower.

While most investors and retail traders react emotionally to market selloffs, those who maintain a long-term perspective and continue accumulating assets set themselves up for major gains when the market recovers.

Now Is the Time to Act

Market downturns separate those who believe in the power of investing from those who let fear dictate their decisions. The investors who get rich in the next bull market will be the ones buying assets while others are selling!

Right now, the market is presenting an opportunity.

Stocks are cheaper, yields are higher, and income-producing assets are more attractive than they have been in years. The question is: will you take advantage of it, or will you let fear keep you on the sidelines?

This is not a time to hesitate. It is a time to expand, accumulate, and build wealth for the future!!

GP’s Wrap-Up🐼

The Second Income Stream is not just about investing—it is about creating a financial foundation that provides security, freedom, and independence.

Market corrections, while uncomfortable, are the exact moments that build long-term wealth.

This selloff is either a setback or a setup for future financial success.

The difference lies in how you respond.

Will you let fear hold you back, or will you use this moment to accelerate your wealth-building journey?

The choice is yours.

Let’s go, MFG!!

Let me know if I can do anything to help.🤘

Always remember, whatever you think about comes about, whatever you focus on grows. - GP 🐼

The Second Income Stream - Your Guide To Achieving Financial Freedom

An Historic Update From The MFG Headquarters in The French Quarter of New Orleans!!‼️🚨❄️🏰🐼

On Tuesday, January 21, 2025, The MFG Headquarters experienced a rare and historic snow day—a powerful reminder that, much like the market, life is full of unexpected opportunities.💥❄️

It also made me deeply grateful for the freedom to stay to my beach condo whenever I choose, a privilege made possible through persistent effort, dedication, hard work, commitment, and the daily pursuit of financial freedom.🙏🙌

This is why learning a wealth building skill like swing trading is crucial to you and your family’s financial wealth and success in life.📈🔑

The goal is financial freedom— to be the CEO of you— in full control of your own time.⏰💪

👉No bosses, no alarm clocks, no schedule, and no rushing around in traffic on autopilot five days in a row.😱🤮

This is exactly what I aim to share with you here on The Second Income Stream: a blueprint and actionable path to building and achieving financial freedom.🙌🤝

Keep in Flow💰🌊

Financial Disclaimer

The information provided in this publication is for educational and informational purposes only and does not constitute financial advice, investment advice, or a recommendation to purchase or sell any securities. Past performance is not indicative of future results, and all trading and investment decisions carry inherent risks.

Participants should conduct their own research and consult with a licensed financial advisor or professional before making any financial decisions. Gerald Peters and The Second Income Stream are not liable for any financial losses incurred as a result of trading or investing based on the strategies discussed in this publication .

By subscribing to this publication, you acknowledge and agree to assume full responsibility for your trading and financial decisions.

Time to increase that cash flow to keep building wealth.

Thank you GP!!!