The Sunday Edition of The Second Income Stream 4-13-25

New Income Fund Ideas & GP's Playbook for The Week Ahead

Hey, MFG!!🤘

YES! YES! YES!👏👏

The Second Income Stream is all about share count and dividend income. Do you know your annual, monthly, weekly, and daily dividend income?

These numbers are important and calculation of them should become automatic.

The priority here is INCOME. 👈

This isn’t about trading or traditional investing.

You’re not trimming funds to take gains—that only decreases your share count, lowers your dividend income, and increases your taxes.

The goal is simple: use margin and dividends to acquire income-generating assets, reinvest dividends to compound growth, and build a scalable passive income stream in the stock market.

This could be your blueprint to financial freedom—but it requires a disciplined approach.

The vision?

Create enough passive income so you can do what you want, when you want, for the rest of your life.

The Sunday Edition of The Second Income Stream 4-13-25

Tier 1: Anchor Funds

Cornerstone Strategic Investment Fund, Inc. (CLM)

Cornerstone Strategic Investment Fund, Inc. CLM 0.00%↑ is trading in a stage 1 accumulation zone below its 200-day SMA, along with its sister fund Cornerstone Total Return Fund, Inc. CRF 0.00%↑ .

Both funds have a Rights Offering (RO) coming up.

Shares must be purchased by 4/21/25 to qualify for the RO and Cornerstone is offering holders 1 share for every 3 shares owned at the discounted price.

🐼Other Tier 1 anchor funds I’m watching or looking to add to this week: GUT, GOF, ASGI, GLV, PSEC, HIPS, BCAT, BIZD, REM, USA, ASG, EIC, and ECC.

Tier 2: Leveraged-Index Option Income ETF

ProShares Bitcoin Strategy ETF (BITO)

A stage 2 breakout is underway ProShares Bitcoin Strategy ETF BITO 0.00%↑ .

BITO is my favorite Bitcoin income fund. I’ve been in this one for a few years now and have collected many lucrative monthly dividends.

I’ve been accumulating BITO in my M1 finance leveraged Skydweller portoflio. It’s only 40% margin maintenance (MM) on M1, whereas on E*Trade it’s 100%.

I also like CEPI here as another crypto monthly income play, which is only 50% MM on E*Trade.

🐼Other Tier 2 funds I’m watching or looking to add to this week: CEPI, USOY, AIPI, GIAX, YMAX, YMAG, IWMY, QQQY, WDTE, SPYI, XPAY, RDTE, XDTE, QDTE, RDTY, QDTY, and SDTY.

Tier 3: Single Stock YieldMax Covered Call ETF

YieldMax Innovation Income Strategy ETF (OARK)

YieldMax Innovation Option Income Strategy ETF OARK 0.00%↑ is in a stage 1 accumulation zone. This is a perfect Money Flow stage 1 setup.

The RSI went extreme, price got above its 5-day EMA, the TSI has curled and is just about to cross, and the MACD histogram has been ticking upwards. There’s confluence of the Money Flow indicators.

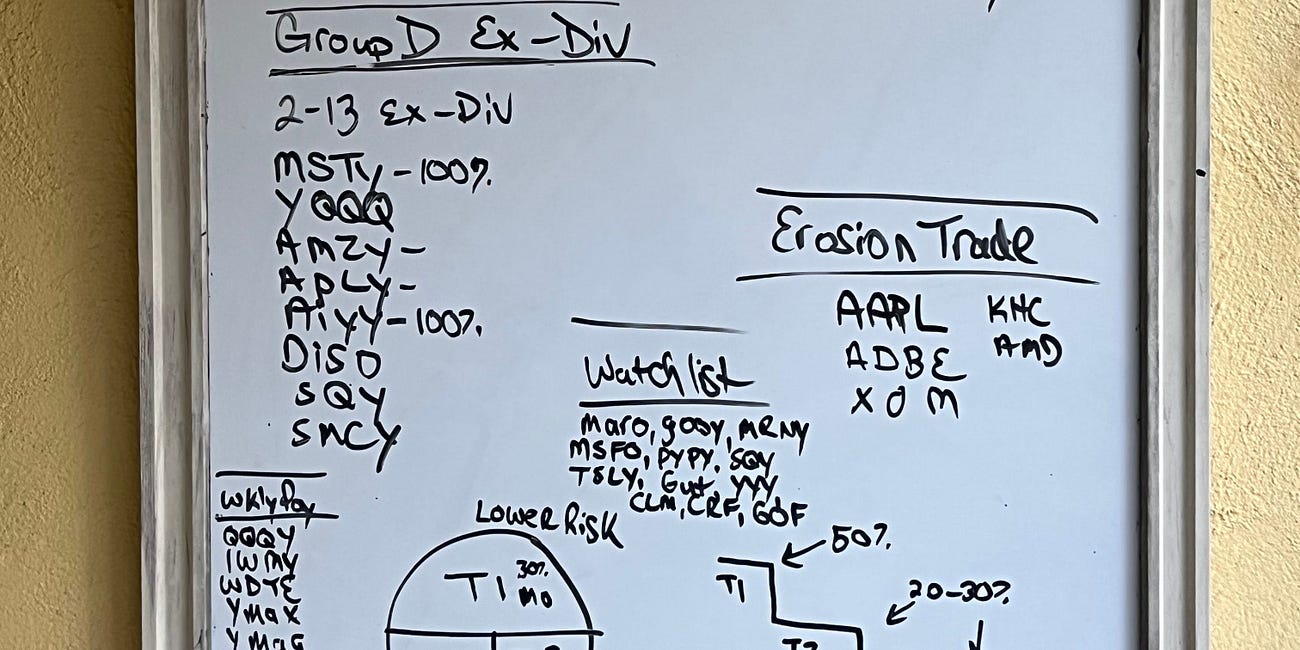

I’m looking to pick up shares here to increase my dividend payout for Group A this Friday, April 18th.

I like OARK as a tier 3 fund because it’s only 30% MM.

Remember, this is a single stock options ETFs. Maintain a proper position size of 1-3%.

🐼Other Tier 3 funds I’m watching or looking to add to this week: TSLY, GOOY, TSMY, SNOY, AIYY, ABNY, AMDY, NVDY, PLTY, APLY, CONY, SOXY, ULTY, and GPTY. Mortgage REITs AGNC, MFA, and ARR as well.

Below is GP’s private video on position sizing.

Tier 4: Erosion Buster Trades

iShares Semiconductor ETF (SOXX)

iShares Semiconductor ETF SOXX 0.00%↑ is in a stage 1 accumulation zone below its 200-day SMA.

Price dropped an anchor point, went sideways for 3-4 days, and closed above its 5-day EMA. The RSI went extreme, the MACD histogram is ticking upwards and the TSI had curled and crossed.

There’s confluence of the Money Flow indicators here.

Targets are the 200-day SMA or an extreme-high RSI reading.

SOXX is a sector-focused ETF that provides exposure to U.S.-listed semiconductor companies, tracking the performance of the ICE Semiconductor Index.

It holds top industry leaders like NVIDIA, Broadcom, Taiwan Semiconductors, Advanced Micro Devices, and Qualcomm, offering diversified access to the entire semiconductor value chain—from chip designers to manufacturers.

SOXX is a cost-effective way to invest in the high-growth semiconductor industry, which has been a key driver of innovation in AI, 5G, cloud computing, and more.

SOXX is only 30% MM and a diversified way to play the semiconductors trade. I also like AMD, TSM, and NVDA.

I also like GOOGL as an erosion trade here. This a simple, high-quality trade and it’s only 30% MM.

According to analyst Malik from Morningstar, GOOGL has a fair value of $237 and is currently trading undervalued.

🐼These are the erosion buster trades I’m watching or looking to add to once the markets set up: XLB, XLY, XLK, XLU, KRE, GOOGL, AMD, AAPL, RACE, HBI, FCX, NUE, F, KHC, IRM, and DLR.

E*Trade Margin Maintenance (MM) Requirements

Current E*Trade margin maintenance (MM) for the mentioned securities in this article.

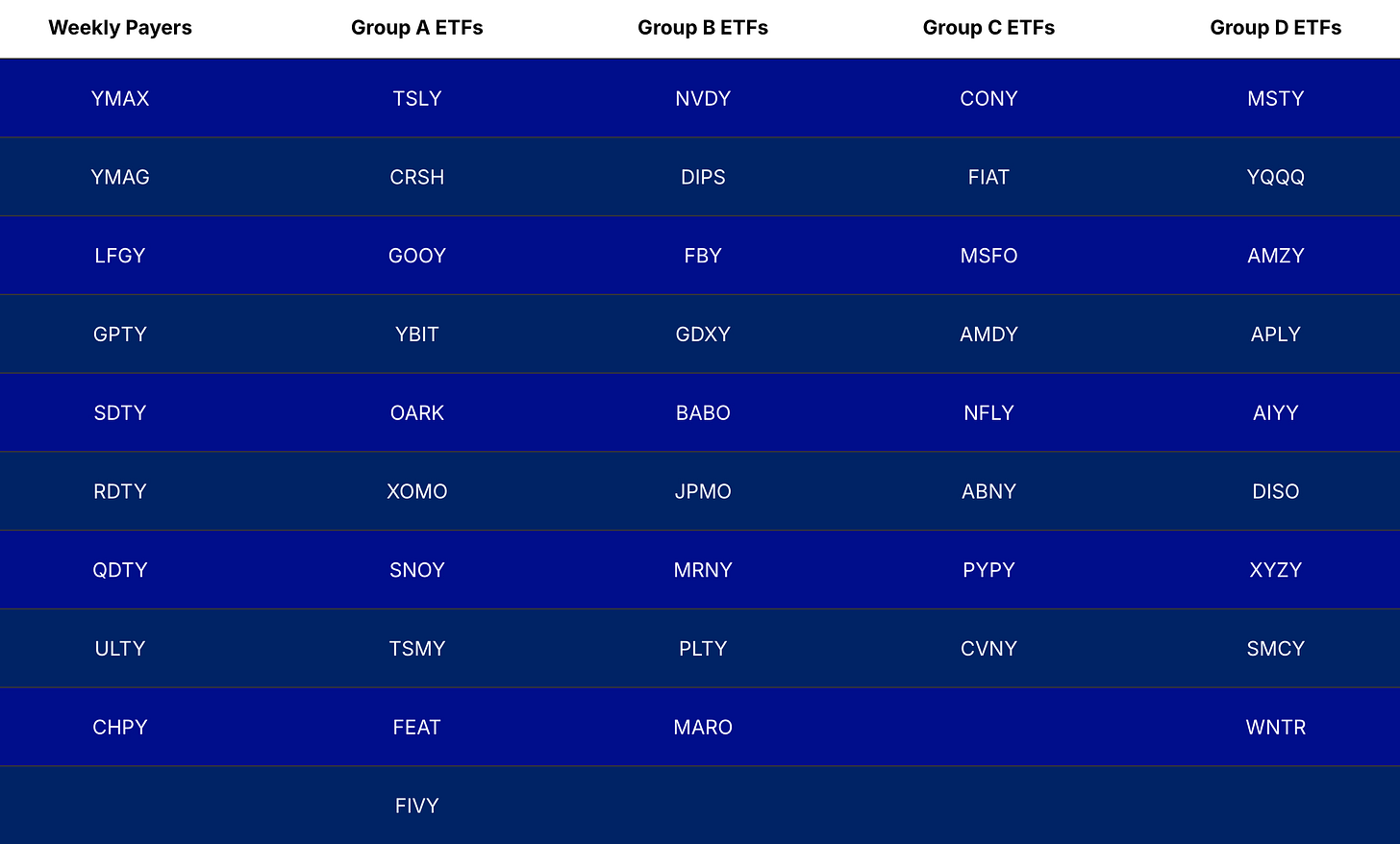

YieldMax Funds divided by Weekly Payers & Groups‼️

G’s Wrap-Up🐼

The main funds and trades I’m watching this week:

Tier 1: CLM, CRF

Tier 2: BITO, CEPI

Tier 3: OARK, TSLY

Tier 4: SOXX, GOOGL

👉Let me know in the comments if you have any questions.👈‼️

I truly appreciate you and your continued support, commitment, and motivation. If I can do anything to help you, let me know.🤘

Always remember, whatever you think about comes about, whatever you focus on grows. - GP 🐼

The Second Income Stream - Your Guide To Achieving Financial Freedom

THE SIS HOMEWORK ARTICLE - GP’s NEW TEMPLATE

GP’s Latest Second Income Stream YouTube Video

Keep in Flow🌊

Financial Disclaimer

The information provided in this publication is for educational and informational purposes only and does not constitute financial advice, investment advice, or a recommendation to purchase or sell any securities. Past performance is not indicative of future results, and all trading and investment decisions carry inherent risks.

Participants should conduct their own research and consult with a licensed financial advisor or professional before making any financial decisions. Gerald Peters and The Second Income Stream are not liable for any financial losses incurred as a result of trading or investing based on the strategies discussed in this publication .

By subscribing to this publication, you acknowledge and agree to assume full responsibility for your trading and financial decisions.

Another great article. Thank you!!

Great time to anchor the portfolio💪🔥Thank you Gp and Jess for all the time put in to these🙏💎🔥