The Margin Call Playbook: Full 5-Part Case Study Series in Real-Time Now Available

How to stay in control of your Second Income Stream portfolio when the market goes against you.

Hey, MFG!!

YES! YES! YES!

If you’re going to use margin, you really need to compartmentalize these two words: margin call.

A margin call happens when the value of your portfolio falls below the required maintenance level, and your broker demands you add more cash or sell assets to bring it back into compliance; to satisfy the margin call.

It’s not personal—it’s mechanical; it’s nothing personal, just business.

However, if you’re not prepared, it can wipe out trades, force losses, decrease your income, lock you out of opportunity, and potentially blow out your account.

So what causes a margin call?

Overextension, or overweight, in volatile funds (especially Tier 3 funds and Tier 4 trades).

Sharp, sudden, quick drawdowns in asset prices like we saw in the tariff crash.

Using too much margin relative to equity; being over-leveraged.

Lack of available buying power to absorb dips. Too low of an available to withdrawal (AW).

Where does it happen?

Inside margin-enabled brokerage accounts; for example, E*Trade and M1 Finance.

Across stocks, CEFs, ETFs, options funds, and even income funds!

Who does it happen to?

Anyone who mismanages risk.

Anyone who is over-leveraged.

Even experienced traders who don’t adjust quick enough.

Or experienced traders who insisted on pushing the limits and being full risk-on.

Why does it matter?

If you’re using margin to build a second income stream, you need to be proactive—not reactive.

You always have to be one step ahead.

You don’t want your broker managing your portfolio for you.

You want to stay in control.

You want pure self-control.

Margin Calls in REAL-TIME & How to Take Strategic Action

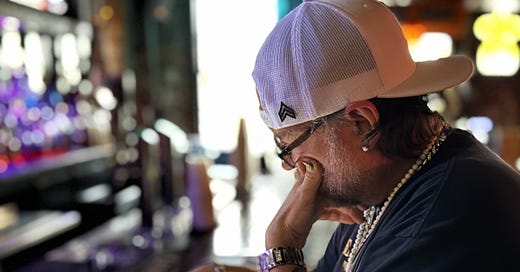

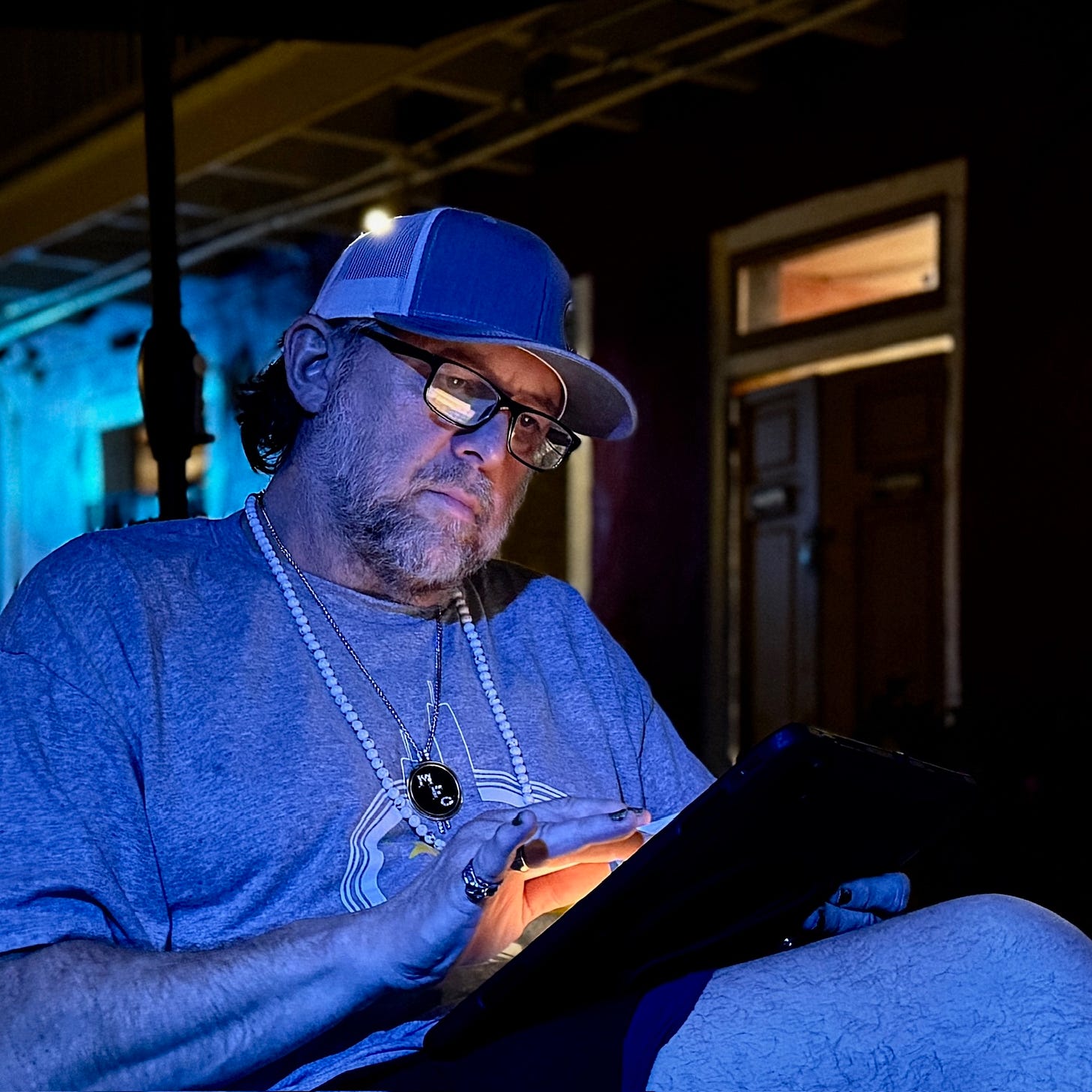

We talk a lot about using margin to accelerate income, but the real test of your system—and your mindset—is how you handle a downturn.

That’s why I created the full 5-Part Margin Call Series.

This is not theory. This is not textbook.

This is real-time execution inside an active income portfolio—how we responded, recovered, and restructured during one of the sharpest, fastest sell-offs tied to the Tariff Crash & Rights Offering Event.

This is the kind of scenario most stock market participants aren’t prepared for, but now you can be!

🐼If you’ve read Parts 1–4, go check out Part 5: Real-Time Case Study Update—How The Income Portfolio Handled The Historical Tariff Crash & Rights Offering.

🐼If you’re new to the series, now’s the time to catch up.

Want to see how margin calls play out in real time?🤘

We’ve got a full 5-part series inside The Second Income Stream that walks you through a real margin call case study from start to finish:

Here’s what’s inside:🤝

Part 1: How the Second Income Portfolio was originally structured

Part 2: The first margin call—what triggered it and how we responded

Part 3: A second margin call just 24 hours later—and how we adjusted

Part 4: How The Margin Account Did After 2-3 Margin Calls in One Week

Part 5: Real-Time Case Study Update—How The Income Portfolio Handled The Historical Tariff Crash & Rights Offering

This 5-part masterclass is only available to paid subscribers of The Second Income Stream.

If you’re serious about learning how to protect your capital, increase your dividend income, manage risk, take advantage, and stay in the driver’s seat when volatility hits—start here.