Should You Buy More at a Discount? Inside Cornerstone’s 2025 Rights Offering

The most important decision Cornerstone shareholders will make this year and everything you need to know to participate.

Hey, MFG!!🤘

YES! YES! YES!👏👏

The Cornerstone Funds are back with their 2025 rights offerings!!

If you hold shares of CLM or CRF, you've likely received an email from your broker or seen the alert in your account.

This annual event gives shareholders the chance to buy more shares, often at a discount, but the process can be new or unclear.

So I’m here to help you simplify this wonderful opportunity in the income world of the stock market right now.

Let’s go, MFG!!

Should You Buy More at a Discount? Inside Cornerstone’s 2025 Rights Offering

A Rights Offering Explained and Why Cornerstone Does It

A rights offering (RO) is when a fund or company gives its existing shareholders the exclusive right to buy more shares, usually at a discounted price, before anyone else.

Think of it like this:

You already own part of the pie, and they’re offering you another slice at a discount before serving anyone else.

Why They Do This

For closed-end funds (CEF) like Cornerstone Strategic Investment Fund, Inc. CLM 0.00%↑ and Cornerstone Total Return Fund, Inc. CRF 0.00%↑ , a RO helps them:

Raise fresh capital to invest or sustain their distributions.

Grow the fund’s size, allowing more flexibility and potential buying power.

Reward loyal shareholders with access to discounted shares.

But they also increase the total number of shares, which means:

You could be diluted (your slice of the pie gets smaller) if you don’t participate.

The fund gets more assets, but existing net asset value (NAV) per share may temporarily drop.

That’s why many income-focused investors and traders choose to participate, to keep their ownership percentage steady and accumulate more dividend-paying shares at a bargain.

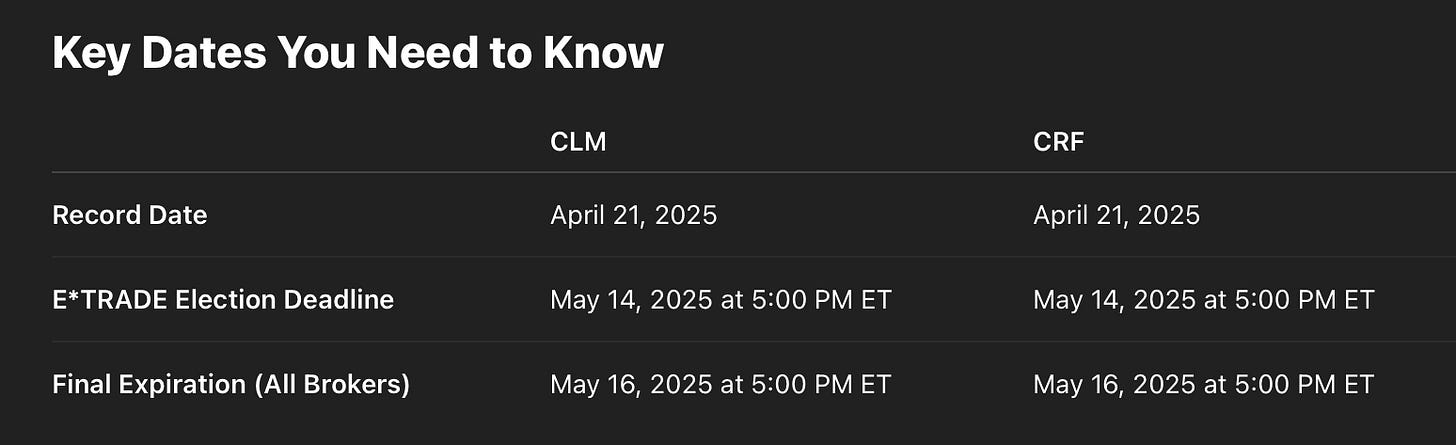

What’s Happening in 2025 and Important Dates To Know

Both Cornerstone Strategic Value Fund CLM 0.00%↑ and Cornerstone Total Return Fund CRF 0.00%↑ are conducting 1-for-3 non-transferable rights offerings.

This means that for every 3 shares you own, you get 1 right to buy an additional share at a discounted price.

These rights are only available for a certain period. They expire soon and require cash in your account—you cannot use margin or DRIP (dividend reinvestment) to pay for the new shares.

Confirmed Subscription Prices

CLM: $6.29 per share

CRF: $6.61 per share

These are fixed based on the greater of 112% of NAV or 80% of market price at expiration.

The prices were confirmed inside the E*TRADE rights election portal.

A Simple Explanation of How It Works

Imagine you own 3 toy blocks.

Cornerstone says: “Hey, if you already have 3 blocks, we’ll let you buy 1 more for cheap, but you have to say yes quickly.”

You need 3 rights to buy 1 new share.

You must use cash—you can’t use DRIP or margin.

The new shares don’t qualify for the May dividend.

If you want more, you can ask through the oversubscription, but it’s not guaranteed.