10 Key Terms You Must Know To Succeed in The Stock Market

Develop a strong portfolio using strategies that have stood the test of time.

Hey, MFG!!🤘

YES! YES! YES!👏👏

Financial freedom is a common goal for traders and investors in the MFG, many of whom are building wealth through smart, consistent, and strategic dividend income investing.

Mastering key investment terms is essential for anyone looking to navigate the stock market with confidence.👈

Whether your focus is on swing trading, dividend investing, high-yield income strategies, or leveraging financial instruments like margin, understanding these concepts can help you maximize returns while minimizing risk.

Achieving financial freedom is simple, but not easy. It requires daily, consistent, smart, intentional hard work.👈

The stock market rewards those who are disciplined, patient, prepared, and show up everyday.

This article highlights 12 essential terms that every sophisticated investor, trader, and individual in the stock market should know to increase passive income, build significant wealth, and succeed in the stock market.👈

By learning these terms, you’ll be better equipped to make informed financial decisions, build passive income, and strategically grow your wealth.

-GP a.k.a Fullauto11 🧙🐼

The Second Income Stream - Your Guide To Achieving Financial Freedom

👉JOIN THE MFG DISCORD!!

Looking for a group of likeminded people to trade with? Text alerts and the MFGDiscord. Text GP 1-936-661-7786 or email GP fullauto11@gmail.com to join.

👉GAIN EXCLUSIVE ACCESS TO THE SECOND INCOME STREAM!!

Unlock the full potential of high-yield investing by upgrading to a premium subscription to The Second Income Stream. Get exclusive access to GP’s top-tier income strategies, fund updates, portfolio insights, and step-by-step guidance on leveraging margin for maximum cash flow. Upgrade today and take control of your financial future!

12 Key Terms You Must Know To Succeed in The Stock Market

For many investors, the path to financial independence starts with mastering the fundamentals of investing and understanding how to generate consistent passive income.

The most successful investors know that building wealth isn’t about luck—it’s about putting in the work, staying informed, strategic decision-making and leveraging the right tools.👈

This article breaks down 12 key investment terms that every serious investor and trader should know.

By grasping these concepts, you can make smarter financial choices, maximize returns, and reduce risk as you work toward financial freedom.👈

1. Margin– Amplifying Buying Power

What It Means: Margin is a form of leverage where an investor or trader borrows funds from a brokerage to purchase more securities than their available cash would allow. The borrowed funds are collateralized by the securities in the investor’s account, and interest is charged on the borrowed amount.

Why It’s Important: Using margin can increase potential gains, but it also magnifies losses. It’s a valuable tool for investors looking to accelerate portfolio growth, but it requires careful risk management to avoid margin calls or forced liquidations.

👉The Second Income Stream Strategy uses margin to leverage your capital to buy different types of funds and stocks to create a passive income stream with dividends to buy even more income.

2. Real Estate Investment Trusts (REIT)– Earning from Real Estate Without Owning Property

What It Means: A REIT is a company that owns, operates, or finances income-producing real estate across various sectors, including residential, commercial, healthcare, and industrial properties. REITs are structured to distribute at least 90% of their taxable income to shareholders as dividends, making them attractive for income investors.

Why It’s Important: REITs allow investors and traders to gain exposure to real estate without the challenges of property management. They offer steady income streams, diversification benefits, and potential long-term appreciation.

👉Different REITS included of the Second Income Stream Strategy are REM, AGNC, MFA, and ARR.

3. Business Development Companies (BDCs)– High-Yield Investments in Growing Businesses

What It Means: A BDC is a type of investment company that provides capital to small and mid-sized businesses through debt and equity investments. BDCs were created by Congress to help facilitate funding for growing private companies while allowing investors to participate in their success.

Why It’s Important: BDCs are required to distribute at least 90% of their taxable income to shareholders, similar to REITs. While they offer high dividend yields, they also come with higher risk, as they invest in businesses that may lack financial stability.

👉PSEC is a BDC that’s part of the tier 1 anchor funds in the Second Income Stream strategy.

4. Exchange-Traded Funds (ETFs)– A Simple Way To Diversify

What It Means: An ETF is a pooled investment fund that holds a diversified portfolio of stocks, bonds, or other assets, which trades on an exchange like a stock. ETFs can track indexes (the Nasdaq QQQ 0.00%↑ and the S&P 500 SPY 0.00%↑ ), sectors (Energy XLE 0.00%↑ and Technology XLK 0.00%↑ , commodities, or specific investment strategies (options income funds).

Why It’s Important: ETFs provide broad market exposure, diversification, and lower expense ratios compared to actively managed funds. They allow investors to access a variety of assets in a single trade, making them ideal for both beginners and seasoned investors.

5. Master Limited Partnerships (MLPs)– Energy Sector Income Generators

What It Means: An MLP is a publicly traded partnership that primarily operates in the energy and natural resources sector, particularly in oil and gas pipelines, storage, and refining infrastructure.

Why It’s Important: MLPs provide attractive yields since they are required to distribute most of their earnings to investors. However, they are sensitive to energy price fluctuations and regulatory changes, which can impact their performance.

👉A few MLPs I’m in include: EQT, ET, and MPLX.

6. Ex-Dividend Date– The Cutoff for Dividend Eligibility

What It Means: The ex-dividend date is the cutoff date for purchasing a stock and receiving its upcoming dividend. If an investor buys a stock on or after the ex-dividend date, they will not receive the next dividend payment. Instead, the dividend is paid to the previous shareholders who owned the stock before this date.

Why It’s Important: Understanding the ex-dividend date allows investors and traders to plan their stock purchases strategically to ensure they receive dividend payouts. Many dividend investors track these dates closely to maximize passive income and avoid missed payments.

GP’s most recent video explaining ex-dividend date.🤘

7. Closed-End Funds (CEFs)– Income & Growth Potential

What It Means: A CEF is a publicly traded investment fund with a fixed number of shares issued through an initial public offering (IPO). Unlike mutual funds, CEFs trade on exchanges at market-driven prices, which can be at a premium or discount to their net asset value (NAV).

Why It’s Important: CEFs offer higher-than-average yields, often utilizing leverage to enhance returns. Investors can capitalize on discounts to NAV when making purchase decisions, but must also consider the risks associated with leverage and market volatility.

👉The Second Income Stream Strategy focuses on CEFs for its tier 1 anchor funds.

8. Dividend Reinvestment Plan (DRIP)

What It Means: A DRIP allows investors to automatically reinvest their dividends to purchase additional shares of the stock rather than receiving the dividend in cash.

Why It’s Important: By reinvesting dividends, you leverage the power of compounding to grow your portfolio faster over time. It’s a strategy for building wealth incrementally without needing extra cash investments, making it ideal for long-term growth and passive income accumulation.

👉When I first started buy and hold investing, I set all my dividend stocks to DRIP.

9. Net Asset Value (NAV)

What It Means: The net asset value (NAV) represents the per-share value of a fund’s assets minus liabilities, calculated by dividing the total assets by the outstanding shares.

Why It’s Important: Investors use NAV to assess the fair value of funds, particularly CEFs. Knowing when to buy below NAV and avoid premiums can help maximize returns and ensure you're making smart, informed investment decisions.

10. DRIP at The NAV– Optimizing Dividend Reinvestment

What It Means: DRIP at NAV refers to the practice of reinvesting dividends at the fund’s net asset value, rather than at the market price. This allows investors to avoid paying premiums on new shares.

Why It’s Important: Since some CEFs trade at significant premiums, DRIP at NAV ensures that reinvested dividends purchase more shares at a fair valuation, maximizing the investor’s long-term return potential.

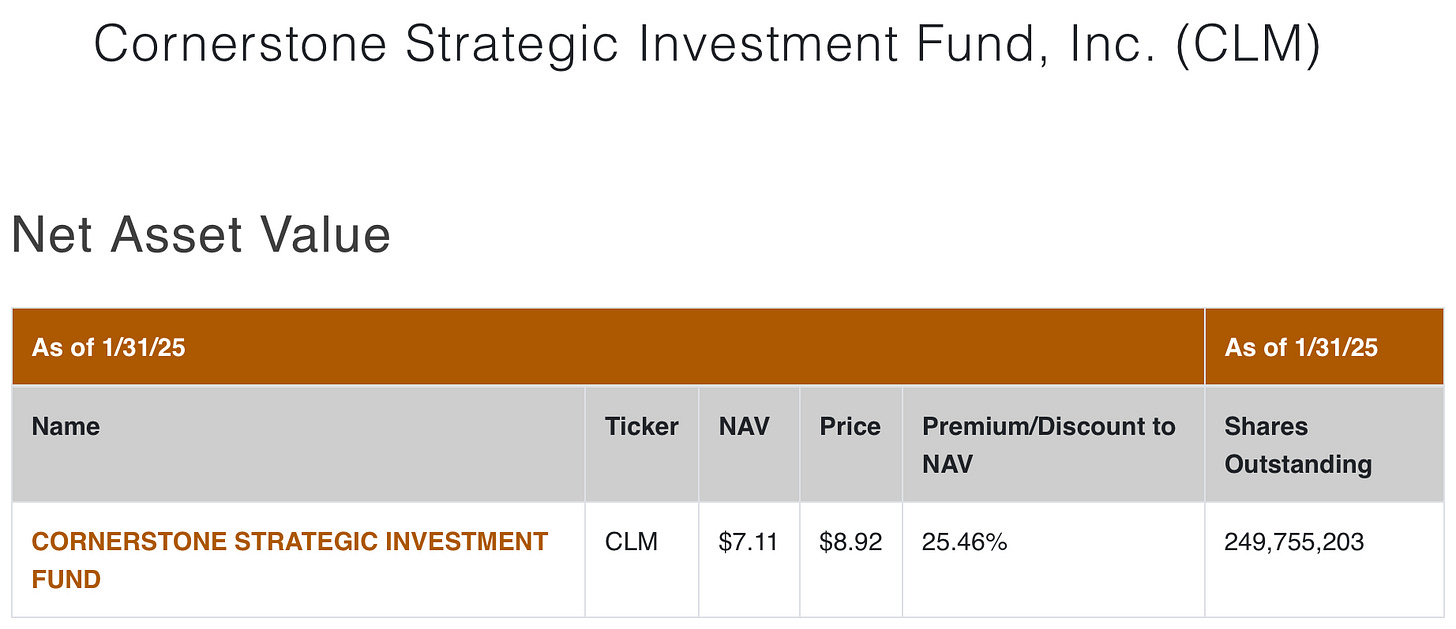

👉CLM is a tier 1 anchor fund part of the Second Income Stream that drips at the NAV.

11. Tax-Advantaged Accounts– Tax-Sheltering Your Money To Keep More of Your Profits

What It Means: Tax-advantaged accounts, such as IRAs, 401(k)s, and Roth IRAs, offer preferential tax treatment to help investors reduce or defer taxes on investment gains.

Why It’s Important: Using tax-advantaged accounts strategically can increase net investment returns over time. By reducing taxable income and deferring capital gains taxes, investors can maximize long-term wealth accumulation.

👉I began investing in real estate and once I accumulated enough houses, I rolled profits forward from rental income into a SEP-IRA to tax shelter the money and have my renters buy my dividend stocks.

12. Collateralized Loan Obligation (CLO)– A High-Yield Debt Investment

What It Means: A CLO is a structured financial product backed by a pool of corporate loans, typically issued to businesses with lower credit ratings. CLOs are divided into tranches, with higher-rated tranches receiving lower yields but more stability, while lower-rated tranches offer higher returns but increased risk.

Why It’s Important: CLOs provide diversification and strong income potential for investors looking to add high-yield debt instruments to their portfolio. However, they carry credit risk, particularly during economic downturns.

👉ECC and EIC are CLOs that are included the Second Income Stream Strategy tier 1 anchor funds.

G’s Wrap-Up🐼

Let’s go, MFG!!👏🙌

Taking control of your wealth through smart stock market investments is one of the most powerful ways to achieve financial freedom.

By mastering these key terms and strategies, you can build a diversified, income-generating portfolio that grows your wealth over time.

Your future financial freedom starts with the knowledge and decisions you make today.

Start Your Journey Toward Financial Independence Today!!

👉Let me know in the comments if you have any questions.👈‼️

I truly appreciate you and your continued support, effort, and motviation. If I can do anything to help you, let me know.🤘

Always remember, whatever you think about comes about, whatever you focus on grows. - GP 🐼

The Second Income Stream - Your Guide To Achieving Financial Freedom

An Historic Update From The MFG Headquarters in The French Quarter of New Orleans!!💥

On Tuesday, January 21, 2025, The MFG Headquarters experienced a rare and historic snow day—a powerful reminder that, much like the market, life is full of unexpected opportunities.💥

It also made me deeply grateful for the freedom to stay to my beach condo whenever I choose, a privilege made possible through persistent effort, dedication, hard work, commitment, and the daily pursuit of financial freedom.

This is why learning a wealth building skill like swing trading is crucial to you and your family’s financial wealth and success in life.📈

The goal is financial freedom— to be the CEO of you— in full control of your own time.⏰💪

👉No bosses, no alarm clocks, no schedule, and no rushing around in traffic on autopilot five days in a row.😱

This is exactly what I aim to share with you here on The Second Income Stream: a blueprint and actionable path to building and achieving financial independence.🙌

I have no doubt you can do this. I did it; so can you! I believe in you.👏

Where two or more are gathered, there is power.👩💻👨💻💥

Always remember, whatever you think about comes about, whatever you focus on grows. - GP 🐼

Keep in Flow‼️🏄

From Margin to Millions: Create Passive Income and Achieve Financial Freedom

Welcome to The Second Income Stream: The Business of Buying Income

Financial Disclaimer

The information provided in this publication is for educational and informational purposes only and does not constitute financial advice, investment advice, or a recommendation to purchase or sell any securities. Past performance is not indicative of future results, and all trading and investment decisions carry inherent risks.

Participants should conduct their own research and consult with a licensed financial advisor or professional before making any financial decisions. Gerald Peters and The Second Income Stream are not liable for any financial losses incurred as a result of trading or investing based on the strategies discussed in this publication .

By subscribing to this publication, you acknowledge and agree to assume full responsibility for your trading and financial decisions.

Drip at the NAV is a cheat code. 🙌🏼

These articles are amazing!!! I get smarter and more knowledgeable with every one I read. Great job and thank you for filling the holes in my knowledge with these priceless gems of articles.